Have the bank-owned credit card associations gotten into the cartoon business?

The popular "Where's Waldo" books are a search-and-find photo scavenger hunt designed as a thinking game for educators to develop exercises for children to learn. In each case, Waldo is hidden in the background and the challenge is to identify where he is.

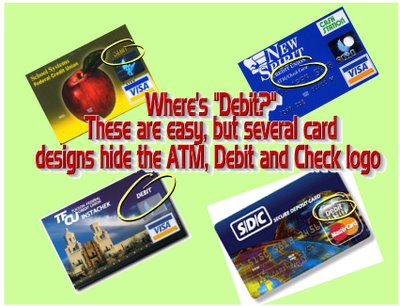

The same activity occurs when a consumer presents a Debit, ATM or Check Card to merchants. In what is becoming a more frequent exercise, retailers are finding it more challenging than ever to identify, not Waldo, but the "debit" or other PIN identification to differenciate the various cards. Why is this so important? Visa and MasterCard's revenues are enhanced when retailers are tricked into accepting the cards which instantly deduct funds from a bank account and forced to pay higher interchange fees.

When a non-credit card is transacted, the rates are significantly lower. Most merchants we have talked with are unaware of the differences in fees and their sales clerks are too busy to play the banks version of the "Where’s Waldo" game. Often, the word "debit" is hidden within the hologram or colored to match the background. An examination of the card requires more than a glance, but the result for running the payment at the much higher credit card rate is a costly oversight.

[commentary: WayTooHigh.com]